Discover Your Path: A Comprehensive List Of Courses In Banking And Finance

Thinking about a career in money matters? Getting into banking and finance can open up many exciting doors, you know. This field, after all, shapes how businesses run and how people manage their wealth. It’s a dynamic area, constantly shifting with new ideas and technologies. Knowing which educational paths are available is a pretty big first step for anyone looking to make a mark here.

Whether you are just starting out or looking to sharpen your existing abilities, finding the right training can feel a bit overwhelming. There are so many options, from college degrees to specialized certifications, each with its own focus. We'll explore some of the main educational routes you might consider, helping you get a clearer picture of what each one offers, you see.

This guide aims to give you a clear rundown of popular choices, helping you figure out what might fit your goals. We will look at different levels of study and various areas of concentration within this big subject. So, you can, like, better prepare for a rewarding journey in the financial world.

Table of Contents

- Why Consider a Banking and Finance Path?

- Different Types of Finance Education

- Undergraduate Degrees in Banking and Finance

- Graduate Studies: Advancing Your Abilities

- Specialized Certifications for Banking and Finance Professionals

- Online Courses and Bootcamps: Flexible Learning Options

- Key Abilities Developed Through Finance Courses

- Choosing the Right Program for You

- The Future of Banking and Finance Education

Why Consider a Banking and Finance Path?

A path in banking and finance offers a lot of opportunities, really. You could work in many different places, like big banks, investment firms, or even for companies managing their own money. The skills you gain are pretty much useful everywhere, you know, whether you are helping individuals with their savings or advising large corporations on mergers.

This sector is also often about making a real difference in people's lives and in the economy. Financial professionals help people achieve their goals, fund important projects, and keep markets running smoothly. It is a field where smart decisions can have a big, positive influence, so.

Moreover, the finance world is always changing, which means there’s always something new to learn. New technologies, different rules, and fresh market conditions keep things interesting. This continuous need for new abilities makes it a stimulating and, frankly, engaging career choice for many.

Different Types of Finance Education

When you think about learning finance, you have several main routes you can take, you see. Each type of schooling has its own benefits and is good for different career goals. Knowing these distinctions can really help you pick what’s best for your situation, you know.

Generally, you can look at university degrees, which give you a broad and deep theoretical base. Then there are professional certifications, which are more focused on specific job abilities. Also, online courses and shorter bootcamps offer quicker ways to pick up certain abilities or get a taste of the field, too.

Picking the right kind of education often depends on where you are in your career and what you hope to do next. Someone just out of high school might want a full degree, while a working professional might prefer a specialized certificate. It just depends, you know.

Undergraduate Degrees in Banking and Finance

Starting with a bachelor's degree is a common way to enter the finance world, actually. These programs usually last about three to four years and give you a strong foundation in money matters. They prepare you for many entry-level positions, you know, and often open doors to further education.

These degrees cover a wide range of topics, from how markets operate to basic accounting principles. You will learn about investments, financial tools, and how businesses manage their money. It is a pretty comprehensive introduction to the field, so.

Bachelor of Business Administration (BBA) in Finance

A BBA in Finance is a very popular choice for folks interested in the business side of things. This program gives you a general business education alongside specialized finance lessons. You will study management, marketing, and operations, for example, which helps you see how finance fits into a larger company structure.

The finance-specific parts of a BBA often include corporate finance, investment analysis, and financial markets. It is a good choice if you want a broad business perspective with a strong financial leaning. You know, it prepares you for many different roles.

Bachelor of Science (BSc) in Finance

For those who really enjoy numbers and detailed analysis, a BSc in Finance might be a better fit. This degree typically has a more quantitative focus, meaning more math, statistics, and financial modeling. It is, you know, a bit more technical than a BBA.

Students in a BSc program often dive deeper into financial theory, derivatives, and risk assessment. If you are aiming for roles that require heavy data work or complex financial calculations, this path could be quite helpful. It is, like, pretty rigorous.

Economics with a Finance Focus

Sometimes, studying economics with a concentration in finance can be a really strong option, too. An economics degree helps you understand the bigger picture of how economies work, which is, like, super important for finance. You learn about market forces, government policies, and global trade.

Adding a finance focus means you apply those economic ideas to financial markets and institutions. This approach can give you a unique perspective, combining broad economic thinking with practical financial abilities. It is, in a way, a very well-rounded education.

Graduate Studies: Advancing Your Abilities

After getting a bachelor's degree, many people choose to go for a master's degree to specialize further or to get into higher-level positions. Graduate programs can really deepen your understanding and open up more advanced career possibilities. They are, you know, a pretty big step up.

These programs are often more intense and focused than undergraduate studies. They are designed for people who already have some background in finance or a related field. You will usually work on more complex projects and research, too, developing very specialized abilities.

Master of Business Administration (MBA) with Finance Specialization

An MBA with a finance focus is a popular choice for those looking to move into management or leadership roles. It gives you a comprehensive business education, covering everything from strategy to marketing, but with a deep dive into financial decision-making. This program is, like, super versatile.

You will learn about corporate finance, investment banking, and financial strategy, all within a business leadership context. It is great if you want to combine strong financial abilities with broader management skills, actually. Many find it opens up a lot of doors.

Master of Finance (MFin)

For a purely finance-focused graduate experience, a Master of Finance (MFin) is a great option. This degree is usually for people who want to specialize deeply in financial analysis, investments, or risk management. It is, you know, very technical and analytical.

MFin programs often cover advanced topics like quantitative finance, financial modeling, and asset pricing. If your goal is to be a financial analyst, portfolio manager, or work in a similar specialized role, this degree can be very beneficial. It is, in some respects, a very direct path.

Master of Science (MSc) in Financial Engineering

An MSc in Financial Engineering is for people with a strong background in math, computer science, or engineering who want to apply those abilities to finance. This program focuses on developing complex financial models and tools, often for areas like derivatives or risk management. It is, like, pretty cutting-edge.

You will learn about stochastic calculus, numerical methods, and programming for finance. This degree is perfect for roles in quantitative analysis, algorithmic trading, or financial technology (Fintech). It is, quite frankly, a very specialized and demanding program.

Specialized Certifications for Banking and Finance Professionals

Beyond degrees, there are many professional certifications that can really boost

Finance course | Top 10 Best Finance courses (with Online Certification)

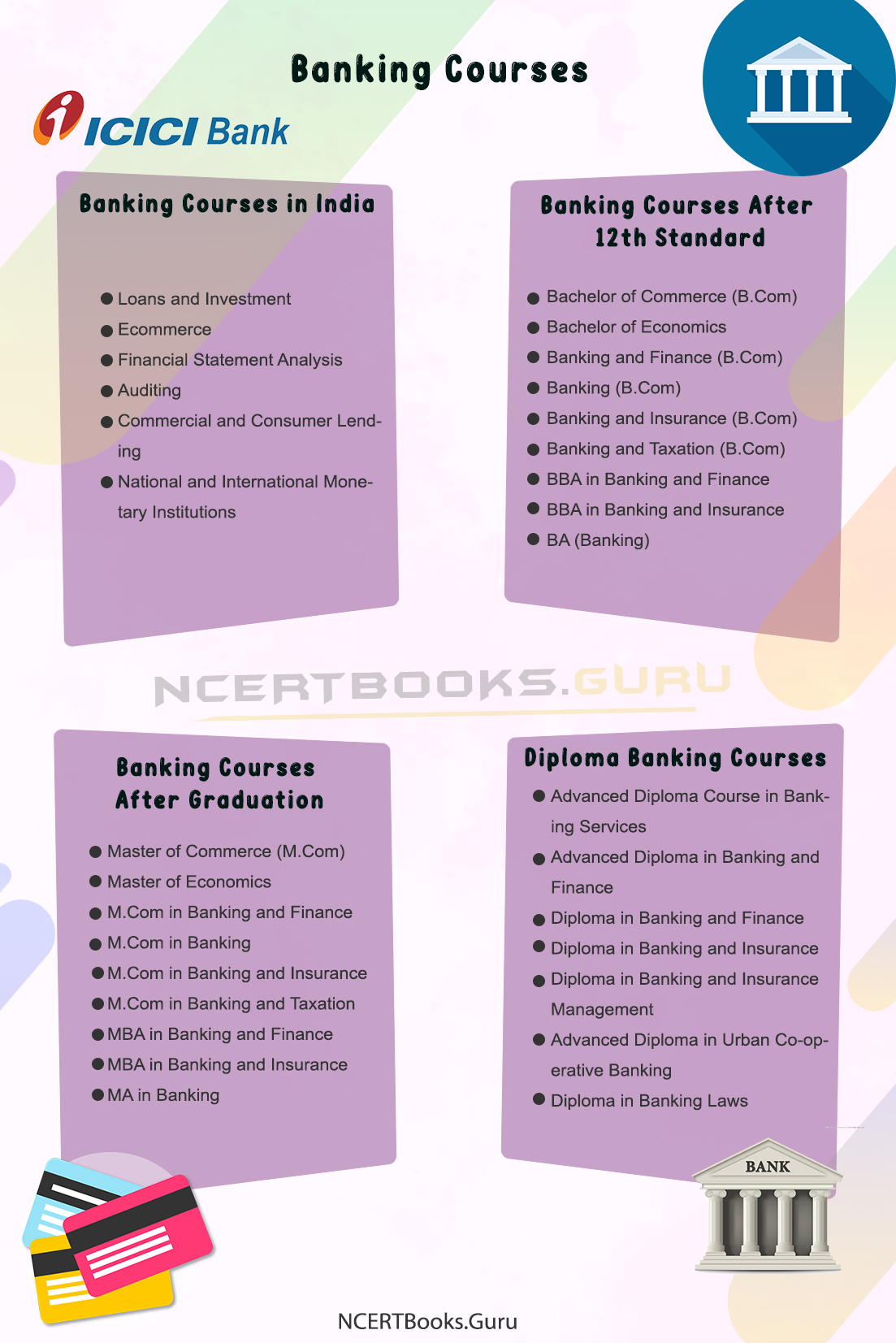

Banking Courses After 12th Standard - Eligibility Criteria, Exam Syllabus

Finance course | Top 10 Best Finance courses (with Online Certification)