Documents Needed For A Small Business Loan: Get Ready Now!

Are you an entrepreneur looking to secure funding for your small business? Navigating the world of loans can seem daunting, but being prepared with the right documentation is the first step toward success.

Every lender, while having their own specific forms and requirements, typically asks for a common set of documents when you apply for a small business loan. This is a crucial aspect, as it prepares you effectively for the application and overall loan process. Having these documents ready can significantly improve your chances of securing the financial backing you need to either launch or expand your business, giving you that much-needed financial boost.

The process of securing financing, whether it be for a new venture or the expansion of an existing one, frequently involves a deep dive into the specifics of financial products and services. Chase Bank, for example, provides a wide range of financial products and services, including checking and savings accounts, credit cards, home loans, and auto financing, offering various options to meet diverse financial needs. However, it's important to remember that the products, services, and lending criteria might differ from those offered through JPMorgan Chase Bank, N.A. or its affiliates. Always remember that past performance isn't a guarantee of future outcomes.

- Who Is Rory St Clair Gainer Everything About Rebecca Fergusons Husband

- Hdhub4u Your Guide To Free Movies Streaming 2024

Securing a mortgage is a significant step for any homebuyer. Mortgages that are insured play a crucial role in the market, directly influencing a buyer's purchasing power. Insuring your mortgage lowers the risk for the lender. This increases your chances of qualifying for a loan, which otherwise may not be available. Chase Homebuyer Grant is available on primary residence purchases only.

For aspiring homeowners looking to finance home renovations or repairs, renovation loans like the FHA 203(k) loan or the Fannie Mae Homestyle loan are available to provide funds for this. However, it's essential to note that Chase does not offer these specific loan products at the present time.

The following table provides a detailed overview of the various loan offerings and financial services provided by Chase Bank. This resource offers a straightforward view, helping you to easily understand the different financial options available to you and their respective benefits.

| Service/Product | Description | Key Features |

|---|---|---|

| Checking & Savings Accounts | Various account options to manage your daily finances, save money, and earn interest. |

|

| Credit Cards | A range of credit cards with different rewards programs, interest rates, and benefits. |

|

| Home Loans | Mortgages, refinancing, and home equity loans to help customers finance or access the equity in their homes. |

|

| Auto Financing | Loans to finance the purchase of new or used vehicles. |

|

| Personal Loans | Unsecured loans for various purposes. Chase offers "My Chase Loan". |

|

Chase Bank Official Website

Chase Bank offers a versatile array of financial products and services, catering to both personal and business needs. You can get a loan from your cards unused credit line with My Chase Loan(sm). It offers checking and savings accounts, credit cards, home loans, auto financing, and more, providing a one-stop-shop for various financial requirements.

One of the options is My Chase Loan, which allows borrowers to access a portion of their existing credit cards available credit and repay the loan over a fixed term. The minimum loan amount is $500, and the maximum depends on the borrowers credit profile and card limit.

Understanding the different types of loans can significantly help you in making the correct choice. Chase provides two main types of personal loans: Secured personal loans, which are backed by collateral (like a savings account or certificate of deposit), offer lower interest rates and larger amounts. Unsecured personal loans don't require collateral.

When you consider applying for a loan, lenders analyze not just your credit history, but also your ability and willingness to repay the loan in the future. At Chase, they may be able to help you buy a home even if your credit isnt perfect.

For entrepreneurs, securing capital is essential, and traditional loans are just one option. There are other alternative financing options to consider, especially for those with new businesses or limited credit history. Determine exactly how much funding youll need and what you will use it for. This is essential for raising and employing capital, allot resources and plan purchases. You will have many investments to make at the launch of your business, such as product and services development, new technology, hiring, operations, sales and marketing.

Whether you're considering a home purchase or other financial needs, it's crucial to consider your personal situation and objectives. Seek advice from financial professionals. Remember that outlooks and past performance are not guarantees of future results. Chase is here to support you at every stage of your business journey.

Its always important to remember that while the information shared can offer valuable insights, it is not intended to provide legal, tax, or financial advice, nor does it imply the availability or suitability of any JPMorgan Chase Bank, N.A. product or service. You should also carefully consider your needs and objectives before making any decisions, and consult the appropriate professional(s).

Before committing to any financial agreement, carefully consider your needs, objectives, and consult the appropriate professionals. Chase is not responsible for, and does not provide or endorse third-party products, services, or content.

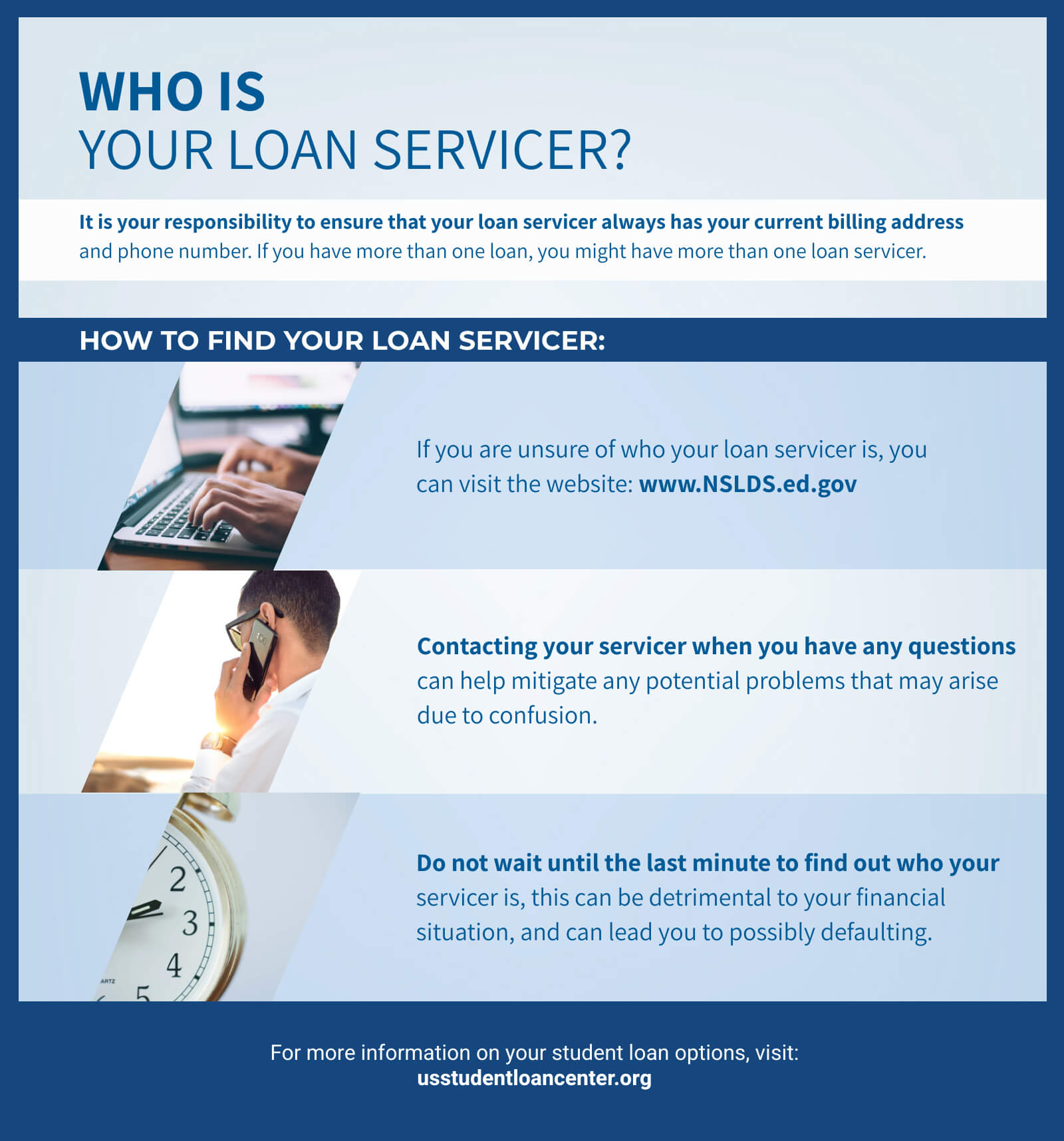

When it comes to student loans, you may want to shop for student loans using an online loan calculator and other handy tools to help cut through the vast landscape of lenders. Consider the features, variable rates can change over time, and the length of your loan term may vary. The shorter your loan term, the higher your monthly payment may be.

If, for example, your payment has increased above your comfort level, you want a more stable payment, or your goals or lifestyle have changed since you got your loan. Get the banking services help you need with Chase customer service. We'll help you find answers to your questions today!

Detail Author:

- Name : Sadye White

- Username : kledner

- Email : brook43@gmail.com

- Birthdate : 1993-12-15

- Address : 86629 Henri Expressway Apt. 286 West Rosie, SD 62727

- Phone : +15626402539

- Company : Konopelski-Crist

- Job : Assessor

- Bio : Necessitatibus voluptas nostrum natus enim nisi voluptas. Iure sapiente eum sint aut magnam tenetur molestiae. Reprehenderit minima aliquid architecto culpa.

Socials

facebook:

- url : https://facebook.com/emanuelschaden

- username : emanuelschaden

- bio : Quisquam officiis quisquam fugit aut et ut iure.

- followers : 1227

- following : 1912

twitter:

- url : https://twitter.com/emanuel7948

- username : emanuel7948

- bio : Sit laborum voluptas minus recusandae iste. Ut qui inventore explicabo omnis.

- followers : 5955

- following : 2622

instagram:

- url : https://instagram.com/emanuel.schaden

- username : emanuel.schaden

- bio : Et aspernatur repellat et est ea natus maxime soluta. Quia maxime saepe odit odio quis.

- followers : 4425

- following : 1704

linkedin:

- url : https://linkedin.com/in/schaden1974

- username : schaden1974

- bio : Libero nulla eaque error dolorem.

- followers : 1839

- following : 17

tiktok:

- url : https://tiktok.com/@schadene

- username : schadene

- bio : Et ducimus ad dolorem mollitia rem asperiores tempora nostrum.

- followers : 887

- following : 1696